Navigating the Real Estate Landscape in 2024: Bank of Canada's Interest Rate Dilemma

As we approach 2024, the economic terrain is marked by the Bank of Canada's decision to keep its benchmark interest rate steady at five percent. While the central bank contends with broader economic concerns, the implications for the real estate market are particularly noteworthy. In this article, we'll delve into how the Bank of Canada's stance on interest rates might shape the real estate landscape in the coming year.

Interest Rates and Real Estate Dynamics:

The correlation between interest rates and the real estate market is a well-established one. With the Bank of Canada maintaining the current interest rate, the real estate sector stands to experience both challenges and opportunities.

Impact on Mortgage Rates and Homebuyers:

In the current landscape, where mortgage rates are currently perceived as less affordable, a notable shift is occurring due to the continuous drop in the bond market. This shift is especially evident in the realm of fixed-rate mortgages, which are experiencing a decline. Despite the present challenges, many potential homebuyers are patiently waiting for the Bank of Canada to potentially cut rates. The expectation is that such a move would not only improve the accessibility of mortgage rates but specifically lead to a decrease in variable-rate mortgages. While the affordability of mortgage rates is a present concern, the evolving financial dynamics, driven by the bond market and potential rate cuts, are reshaping the opportunities for homebuyers and influencing the trajectory of the real estate market.

Economic Slowdown and Real Estate Demand:

The central bank's acknowledgment of weaker growth and a cooling job market suggests that the overall demand in the economy may no longer be outpacing supply. This, in turn, could have a nuanced impact on the real estate market. While affordability may improve, the overall demand for commercial spaces, rental properties, and real estate development projects could see a shift.

Rate Cuts and the Real Estate Outlook:

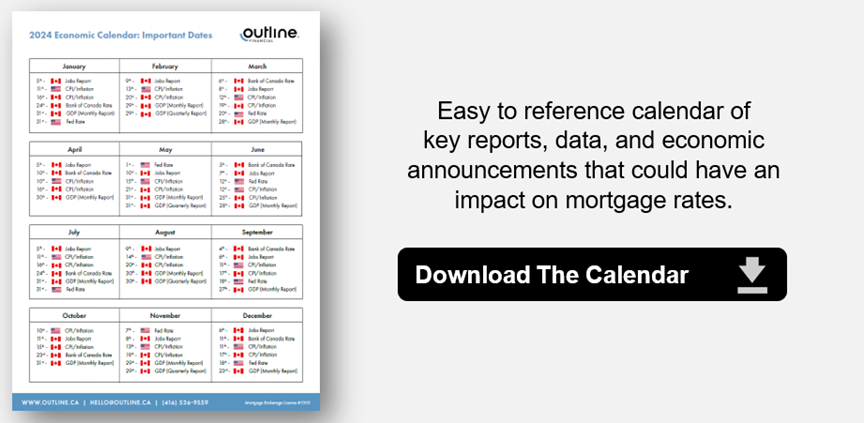

Although the Bank of Canada is not hinting at rate cuts at the moment, speculation in financial markets suggests otherwise. As Canadians await potential rate cuts, the real estate market may experience heightened activity if borrowing becomes even more affordable. Investors and homebuyers alike should stay vigilant, as any shifts in interest rates could influence property values and market dynamics.

Looking Ahead to 2024:

The intricate interplay between interest rates and the real estate market will unfold in 2024. The Bank of Canada's next rate decision in January will be a crucial milestone, offering further insights into the central bank's perspective on economic stability and potential shifts in interest rates.

As stakeholders in the real estate sector prepare for the coming year, the ever-evolving economic landscape and the Bank of Canada's decisions will shape the narrative. From mortgage affordability to investment strategies, the real estate market in 2024 is poised for an interesting journey, influenced by the delicate balance the central bank must strike in addressing broader economic concerns while navigating the unique challenges of the real estate sector.

Recent Posts

GET MORE INFORMATION