2024 Toronto Real Estate Market Predictions

As we step into 2024, the Toronto real estate market is poised for a series of intriguing shifts. Based on current trends and economic indicators, I predict a year of significant changes, particularly in mortgage preferences, property types in demand, and overall market dynamics. Here's a deeper dive into what we can expect in the coming months.

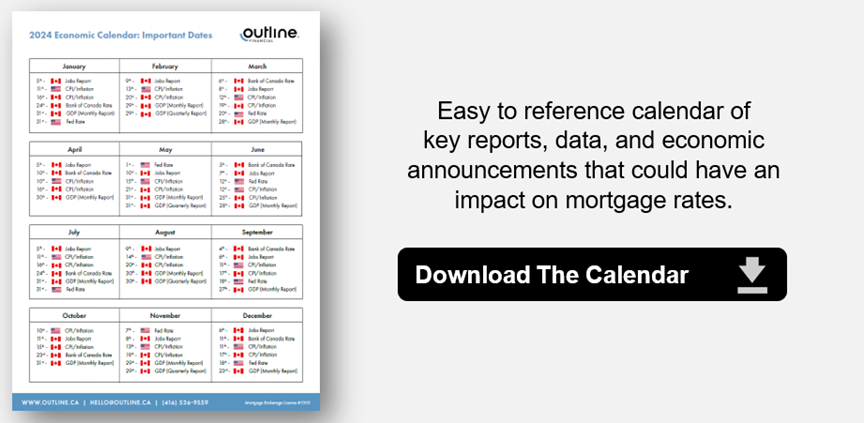

The Resurgence of Variable Rate Mortgages: One of the most notable trends for 2024 will be the resurgence of variable rate mortgages. With anticipated rate cuts beginning as early as March – sooner than many experts predict – the appeal of variable rate mortgages will increase substantially. These mortgages offer flexibility and potentially lower costs, making them an attractive option for new and existing homeowners.

The First Rate Cut - A March Surprise: I foresee the first rate cut happening in March, setting the tone for the rest of the year. This early shift will likely be a response to broader economic changes and will serve as a catalyst for other market movements.

Spring Market: The Era of Turn Key Freehold Homes: Spring 2024 is set to see a surge in demand for turn key or move-in-ready freehold homes. Buyers are looking for convenience and immediacy, and these homes perfectly fit the bill. This demand will not only drive prices up but also create a competitive and dynamic market environment.

Balanced and Competitive Markets for Fixer-Uppers: The market for fixer-upper freeholds will experience a balanced period in the spring, with a resurgence of bidding wars expected in the fall. This shift indicates a growing interest in property investments and renovations, as buyers look to customize their living spaces.

Bank of Canada Overnight Rate Predictions: A significant prediction for 2024 is that the Bank of Canada's overnight rate will drop to 4% or below by year-end, representing a decrease of at least 1%. This reduction will likely have widespread implications for the real estate and financial markets, influencing lending rates and borrowing costs.

The Condo Market: A Slow Recovery: The condo market, while still facing challenges, will gradually find its footing in 2024. Although it may struggle initially, I anticipate a steady decrease in inventory levels throughout the year, signaling a slow but sure recovery.

Final Thoughts

As we navigate through 2024, the real estate market is set to undergo significant transformations. From the growing popularity of variable rate mortgages due to potential rate cuts to the heightened demand for turn key freehold homes, each trend offers unique opportunities and challenges. The fixer-upper market is also set to make a comeback, especially in the fall. Meanwhile, the Bank of Canada's overnight rate adjustments will play a crucial role in shaping market dynamics. Lastly, the condo market's gradual recovery will be an important trend to watch. Overall, 2024 promises to be a year of change, adaptation, and opportunity in the real estate sector.

Recent Posts

GET MORE INFORMATION