This website is an incredibly valuable resource full of top investment opportunities, educational content and more. Welcome!

Top Investment Resources

Hand Selected Investments

Each week we curate the top investment properties across the GTA. Click below to view all of the top investment properties currently on the market.

Laneway House Tour

Our laneway house tour walks you through a completed laneway project as well as the steps and people you need to one of these incredible investments.

Register for our Free laneway house tour.

In person tour of a complete laneway.

Investment Collections

Latest Investment Content

Exceptional Victorian Detached CMHC Investment Opportunity in High Park: 349 Quebec Ave, Toronto

In the realm of real estate investment, seizing opportunities to add substantial value to a property can lead to significant returns. Enter 349 Quebec Ave, a 2.5-storey detached home situated on an expansive 26x160 lot. With the potential to leverage the CMHC MLI Select program, this property presents an exceptional opportunity for experienced investors to capitalize on its prime location and maximize its value. In this blog, we'll explore why 349 Quebec Ave is the perfect investment property for those looking to unlock its full potential through strategic renovations and the CMHC MLI Select program. Prime Location and Potential: Nestled in a desirable neighborhood, 349 Quebec Ave offers investors the chance to tap into the burgeoning real estate market in Toronto. With its generous lot size and existing structure of 2300 sqft over three levels, the property provides a solid foundation for expansion and renovation. Under the CMHC MLI Select program, investors can take advantage of additional financing to fund renovations aimed at increasing the property's value and rental income potential. Strategic Renovation Plan: The key to unlocking value at 349 Quebec Ave lies in a strategic renovation plan that maximizes the property's square footage and rental income potential. By adding a 300 sqft addition to the main and second levels, and as well the basement, investors can expand the footprint of each floor, increasing livable space and enhancing tenant appeal. This expansion allows for the creation of spacious 3-bedroom, 2-bathroom units on each floor, complete with modern amenities and balconies for added outdoor enjoyment. In addition to the basement, main and second-floor units, investors can capitalize on the CMHC MLI Select program to expand the 3rd floor to have a 700 sqft 2 bed 2 bath suite. This unit offers tenants luxurious living accommodations, including a private terrace with stunning views of the surrounding neighborhood. Additionally, you canbuild a 1300 sqft, 3-bedroom, 2.5-bathroom unit in the backyard, which will provide tenants a private and stylish experience. Maximizing Rental Income Potential: With the strategic renovation plan in place, 349 Quebec Ave has the potential to generate substantial rental income. Each floor offers spacious and modern units designed to attract high-quality tenants seeking premium living spaces. The addition of balconies and a terrace enhances tenant satisfaction while increasing the property's overall desirability and rental rates. Location! Location! Location!: One of the great advantages of living in High Park is its excellent Walk Score. Residents of 349 Quebec Ave have easy access to a wide range of amenities, including the REC Centre, Library, Coffee Shops, Eateries, The Annette Food Market, High Park, the subway, Schools, and much more. The neighborhood is known for its vibrant community and offers something for everyone. Numbers At A Glance $20,650 in monthly rents After Reno Value of $4.483M $2.4M Mortgage @ 4.2% amortized over 40 years Annual Cashflow of $89,600 Final Thoughts: For experienced investors seeking to add value to a property and capitalize on the CMHC MLI Select program, 349 Quebec Ave presents an unparalleled opportunity. With its prime location, expansive lot size, and potential for strategic renovations, this property offers the perfect canvas for unlocking its full investment potential. By leveraging the CMHC MLI Select program and implementing a strategic renovation plan, investors can maximize rental income, enhance property value, and achieve long-term success in Toronto's competitive real estate market. Don't miss out on the chance to unlock value and reap the rewards of investing in 349 Quebec Ave. Click Here to see the financials

Read more

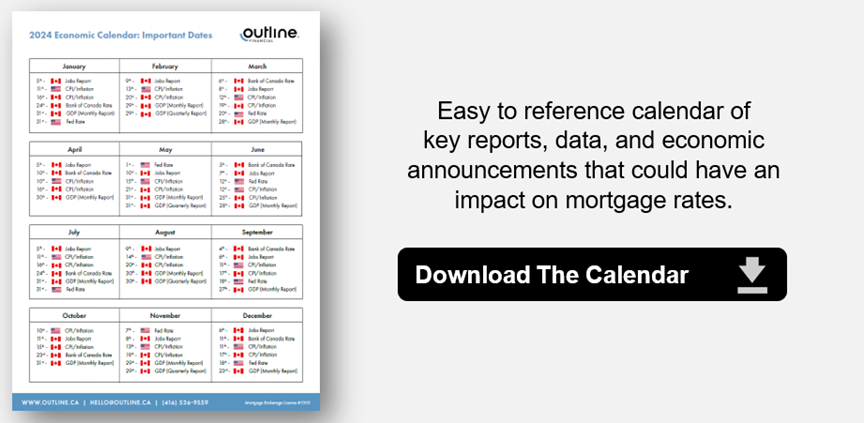

2024 Economic Calendar: Important Dates

Wondering where rates are headed in 2024? While no one has a crystal ball, there are certain dates that can cause waves in the mortgage market. To help calm the waters, we’ve prepared a 2024 economic calendar with key dates of importance. While we haven’t included every date, we are trying to highlight the most relevant that could impact both fixed and variable rates, as well as the overall mortgage market.So what reports & announcements have we included and how can they impact interest rates? Please refer to a quick summary below: “Bank of Canada Rate” – Bank of Canada Meeting / Rate Announcement Dates: The Bank of Canada meets 8 times spread across the year where they provide an update on the economy, and announce any updates to their Overnight rate. The Overnight rate directly affects the Prime rate and Variable rate mortgages, and could indirectly affect fixed rates if changes are different from market expectations. “Fed Rate” – US Federal Reserve Meeting / Rate Announcement Dates: Similar to the Bank of Canada Rate updates, the US Fed updates their Reserve rate. Although there is not a direct link to our Prime Rates, changes by the US Fed will influence the Bank of Canada as well as Fixed rates by impacting Bond Yield performance. “CPI / Inflation” = Consumer Price Index (Statistics Canada / US Bureau of Labor Statistics): These are monthly reports on how inflation was for the previous month. Included is a comparison to the past month as well as the previous year. These occur in both Canada and the US. This is a key metric, where we the central banks want to see inflation come down to a certain range (target is 2% in Canada). As inflation comes under control, we will likely see the Bank of Canada reduce their Overnight rate from the current 5% as of the time of writing. Fixed rates could also see some trends downward if we see inflation cooling trends continue through 2024 & 2025. “GDP” = Gross domestic product, income and expenditure (Statistics Canada): GDP stands for Gross Domestic Product, and is a measure of Canada’s economic performance. If we see growth cooling this may mean we’re headed for recession; in which case we may see bond yields drop potentially leading to lower fixed rates. If GDP strengthens unexpectedly, this will likely mean a surge in Bonds yields and subsequently fixed rates could rise. “Jobs Report” = Labour Force Survey (Statistics Canada): These reports look at both unemployment and labour wage inflation. Labour wage is a key metric for future overall inflation, and so the results could impact Bank of Canada decisions on whether sustained inflation-combating measures are needed or not. We hope you find the above information and the calendar helpful. Should you have any questions, please don’t hesitate to reach out to is and we will connect you with a top mortgage professional.

Read more

The BRRRR Real Estate Method: Building Wealth Through Strategic Investment

When it comes to investing in real estate, there is one long term strategy that stands above the rest...the BRRRR method. BRRRR stands for: Buy, Rehab, Rent, Refinance, Repeat. In this blog, we'll explore the key principles of the BRRRR real estate method and how it can be a powerful tool for building long term wealth. Buy - Strategic Acquisition: The first step in the BRRRR method is strategic property acquisition. Investors target distressed or undervalued properties with potential for improvement. This phase requires a keen understanding of the market, identifying properties that align with the investor's financial goals and the potential for value appreciation. Rehab - Adding Value: After acquiring the property, the focus shifts to rehabilitation. This step involves making necessary improvements to increase the property's value. From cosmetic upgrades to structural enhancements, the goal is to enhance the property's appeal and overall market value, ensuring a profitable return on investment. Rent - Generating Income: Once the property is renovated, the next step is to secure rental income. By attracting reliable tenants, investors can create a steady cash flow stream that contributes to covering expenses and financing costs. The rental income is a critical component of the BRRRR strategy, providing financial stability and offsetting the initial investment. Refinance - Unlocking Equity: With the property rehabilitated and generating income, the investor can now explore refinancing options. Refinancing involves reassessing the property's value and leveraging it to secure a new mortgage. This step allows the investor to pull out a portion of the equity built through the rehab phase, providing capital for future investments. Repeat - Scaling the Portfolio: The true power of the BRRRR method lies in its scalability. Once the property is refinanced and additional capital is obtained, investors can repeat the process with a new property. This iterative approach allows for the continuous expansion of the real estate portfolio, compounding the wealth-building potential over time. Benefits of the BRRRR Method: Forced Appreciation: The strategic rehabilitation phase forces appreciation, increasing the property's value and reducing risk by creating immediate equity in the property. Cash Flow: The rental income generated provides consistent and predicatable cash flow that increases over time. The longer the property is rented, the higher the rental income and the more principal that will be paid off the loan. Equity Buildup: Refinancing allows investors to unlock built-up equity, providing capital for future acquisitions without depleting personal funds. Portfolio Diversification: The repetitive nature of the BRRRR method enables investors to diversify their portfolios across multiple properties, mitigating risks and maximizing potential returns. The BRRRR real estate method is one that has been used by the most successful Realtors in virtually every market on earth. By strategically cycling through the steps of Buy, Rehab, Rent, Refinance, and Repeat, investors can build a robust portfolio, generate reliable income, and position themselves for long-term financial success. As with any investment strategy, thorough research, market understanding, and a calculated approach are crucial to maximizing the benefits of the BRRRR method.

Read more

The best mortgage strategy for 2024.

Your mortgage strategy forms the foundation for the purchase of any home or investment. At the end of the day, you are really buying a payment as much as you are buying a property. The right financing decision can literally cost or save you tens of thousands of dollars over the term of your loan. While no Realtor, Mortgage Broker or Economist have the benefit of owning a working crystal ball, we can provide guidance, predictions and historical data in order to help you make a more informed financing decision. According to the Canadian Association of Accredited Mortgage Professionals, nearly 65% of all mortgages in Canada are fixed, when studies have shown that variable rate mortgages have outperformed their fixed counterparts 90% of the time since 1950. This contradiction highlights the importance of truly understanding and educating yourself when making such a major financial decision. So let's start with the basics. Since March of 2022, the Bank of Canada has increased rates from a low of .25% to the current 5% rate through a series of 10 rate increases. For individuals who had locked in with record low, 5 year fixed rate mortgages, they have been unaffected thus far from the spike in rates, and will continue to be until their mortgages are up for renewal. For those who had chosen variable rate mortgages, they have either seen their payments increase dramatically or seen their principal payments shrink as rates have increased. So does that mean fixed rates are the right choice in today's market? Probably not for most people. When it comes to choosing between a variable or fixed rate mortgage, the most simple rule to follow is, when rates are extremely low, lock in your rate, when rates are higher, stick with a variable. Taking the rule even further, when rate increases are on the horizon look to fixed mortgages and when rate decreases are coming, look to variable. While this is a slight oversimplification of the decision making process, it's also supported by long term data. Below we will provide you with a information and insights in order to: 1. Help you understand the current state of the market. 2. Provide guidance on the strategies that we believe will work best for buyers in the short and long term moving forward. How Are Interest Rates Set? Before we jump into some of the rate predictions for 2024, it's important to understand the difference between what actually drives changes in fixed vs variable rate mortgages. While both rates are ultimately driven by the same economic factors over the long term, in the short term, they are actually set using different mechanisms. The interest rates for fixed-rate mortgages are typically influenced by the bond market. Lenders tie fixed mortgage rates to government bond yields. When bond yields rise or fall, fixed mortgage rates tend to follow suit. In Canada, the bond yields have come down over the past 6 months (A high of 4.4% to a low of 3.1%) as inflation concerns have started to ease and the Bank of Canada has started to communicate that rate cuts are on the horizon. This in turn has driven fixed rate mortgages lower. As of today, a 5 year fixed rate for an uninsured mortgages (a mortgage with at least 20% downpayment) sits around 5.7% which is down from over 6% last year. A variable rate mortgage is directly tied to lender prime rates, which in turn are directly affected by the Bank of Canada's (BoC's) benchmark rate. The benchmark rate has been sitting at 5% since the last interest rate increase in July of 2023. For example, the current TD prime rate is 7.35% and the current RBC prime rate is 7.2%. When it comes to actually securing a variable rate mortgage with any bank or credit union, they will typically offer an actual discount to prime. For example, RBC is currently offering prime minus .3 which would create a mortgage rate of 6.9%. The current outlook for the interest rates in 2024 and beyond. As we look ahead and try to make some educated predictions for interest rates in 2024, it's important to note that we aren't just pulling random numbers out of a hat. In fact, the Bank of Canada tells us more or less exactly where we are going to end up with interest rates... eventually. The long term goal is for the Bank of Canada rate to align with the rate of inflation, which in Canada has a target of 1% - 3%. So where does that leave us now? As of the writing of this article, the latest predictions from top economists are for an initial rate cut of .25% in June or July. In CIBC's recent 2024 forecast, they are anticipating a total of 1.25% in cuts by the end of 2024 and a recent TD Report predicted the Bank of Canada policy rate ending up at 2.25% by the end of 2025. In short, it's only a matter of time before we start to see continued rate cuts and it's almost universally agreed that we are close to the end of this high interest rate cycle. How potential rate cuts will impact variable and fixed mortgages. Using the above predictions as a base allows us to run some scenarios comparing current fixed vs variable mortgage options. Option 1 - 5 Year Fixed at 5.7% - $1 Million Mortgage Since this is a fixed rate mortgage, the math is simple. Your monthly payment over the next 5 years will be $5,762. After the 5 year term you will have paid $73,772 in principal. Option 2 - 5 Year Variable at 6.9% - $1 Million Mortgage To keep this scenario as simple as possible, we are going to assume that the mortgage is 6.9% today but will be 5.7% by the end of the year based on the anticipated rate cuts. This would create an average rate of 6.3% for year one. In year 2 rates will decrease another 1.2 percent which reduce the rate from 5.7% at the start of the year, to 4.5% at the end of the year, with an average of 5.1%. We will then use the 4.5% rate for years 3 to 5. In this scenario, your monthly payments would be as follows: Month 1 at 6.9% = $6,521 Month 12 at 5.7% = $5,762 Month 24 - 72 at 4.5% = $5,042 At the end of your 5 year term you would have paid $82,928 in principal. Comparing the two scenarios, the variable rate option would provide a cost savings of $9206.00 over the term of your loan. Now in a perfect world, where changes in rates were 100% predictable, the choice would of course be easy, go with the variable. Unfortunately, that's not the world we live in, and so we have to make some educated predictions based on both current and past data. The historical advantage of variable vs fixed rate mortgages. Referencing the chart above, we can see that from 2006 to 2022, variable rate mortgages in Canada have demonstrated a notable trend of outperforming their fixed-rate counterparts. The contributing factors to this trend were: 1. the overall decline in interest rates during this timeframe and 2. the economic stability and low inflation Canada witnessed during this period. Looking further back, a study conducted by York University found that between 1950 and 2000 variable rate mortgages have outperformed fixed mortgages 89% of the time. Importantly, this period covers a number of high inflationary periods in the 1970's and 1980's. The current market conditions are obviously quite different than they what we have seen over the past 20+ years, yet we do have a couple of important tools that can help guide our future decisions. Conclusions & Strategy So what mortgage strategy should you use for 2024? In short, we believe that variable rate mortgages are the superior choice for today's buyers. Not only does the historical evidence overwhelmingly favour these types of loans, but we also believe that there are clear signs that the current high interest rate environment is close to it's end. In addition to the above, variable rate mortgages offer buyers more flexibility and lower potential penalties should you wish to break your mortgage durring the period of your loan. This includes if you decide to sell or refinance your loan. In contrast, if you lock in a fixed mortgage and rates decrease substantially, the penalties to break the loan in order to refinance will be signficant. Let Us Help Your Strategize While this blog is great start for your financing journey, there is no substitute to getting advice directly from an expert. We work with one of the top mortgage teams in Canada who can help provide you with personalized advice based on your unique circumstances. Please reach out to us for a personal introduction!

Read more

Government incentives for investors.

When it comes to investing in real estate, the best opportunities are often driven by government policy. Whether it’s through financing, tax benefits or other regulations, the government often shows investors exactly where they want them to focus. Over the past couple of years, the government has introduced a number of initiatives that have made investing in the "missing middle” one of the most lucrative investment opportunities we have seen in years. Additionally, end users who are looking offset their mortgages payments by renting our part of their property (house hackers), will equally benefit from these programs and incentives. What is the missing middle? Simply put, Toronto is filled with residents who live in high density housing (condos) and as they grow older and build families they want to move into more low density housing (houses). In the past, the traditional path has been for these residents to either progressively upsize within the city or for them to move outside of the city to find larger and more affordable homes. In recent years, we have witnessed our population boom, seen significant increases in both purchase and rental prices, and have had older home owners staying in their houses for longer. All of these factors have lead to a massive lack of inventory for low density housing within the city of Toronto. Welcome to the “missing middle”. The demand for this housing type is immense and the supply is almost non existent. This is where the opportunity lies. How is the Government helping? Over the past couple of years the government has quietly introduced a number of initiatives, that when combined together, make this one of the best investment opportunities that we have seen in years. (In our opinion of course) Laneway Houses & Garden Suites: In 2018 the city of Toronto officially allowed laneway houses to be built as secondary dwellings and this initiative has since been expanded in many jurisdictions outside of Toronto. These dwellings have benefited both homeowners and renters by creating profitable income streams for homeowners as well as low density living spaces in desirable neighbourhoods for renters. In addition, these dwellings can be added to existing properties to help investors offset interest rate increases or to simply increase the value of those investments. Generally speaking, a laneway house costs about $350,000 - $400,000 to construct. If you were to finance the entire build cost at today's interest rates, that would equate to about $2000 - $2200 in monthly mortgage payments. When you compare that to the approximately $4000 that they generate in rent, it's easy to see how these dwellings can help homeowners and investors generate long term wealth. “As of Right” 4 Unit Zoning: In April 2023 the city of Toronto approved “as of right” zoning for 4 plexes all across the city. This means that any property in the city can be turned into a 4 plex without any special permission. This new bylaw not only creates the possibility for more multiplex (low density) inventory in the city, but it also creates certainty for investors and significantly speeds up the approval and building process. This provision benefits investors by allowing them to both maximize rental returns for their properties (small units rent for more on a per square foot basis) as well as allowing them to reduce their rental risk by diversifying their tenant pool (Not putting all their eggs in one basket). Development Charge Exemption: Prior to June 2022, anyone looking to legally add a unit to a property would have had to pay a development charge tax of $50,000 for each 1 bedroom and $80,000 for each 2 bedroom. This means for anyone trying to convert a single family home into a 6 bedroom triplex (3 x 2 bedrooms) would have had to pay $160,000 in development charges alone. In June 2022, the city of Toronto removed these development charges for up to 4 units in a property. This change directly aligns and compliments with the 4 unit “as of right” zoning mentioned above, and is further evidence of the government’s motivations and goals. In addition to the above, development charges have also been removed for laneway houses and garden suites. Combined together, this policy change has create hundreds of thousands of dollars in potential savings when compared to years past. No HST on New Builds: In 2023, both the Federal and Provincial governments announced that HST would not apply to the construction of new rental housing of at least 4 units. Typically, when building a rental property, an investor will have to pay HST on both their trades as well as on the building supplies. Since landlords do not collect HST on residential rents, there is no way for them to offset or recoup those costs. This new program now solves that equation and results in tens, if not hundreds of thousands of dollars worth of savings for investors. MLI Select Financing: Simply put…this program is special. If you take one thing from this blog, it’s that you should take the time to fully understand what the MLI Program is and the benefits it can bring to you as an investor. It’s a very unique financial vehicle that has the ability to both reduce the risk and massively increase the value of any real investment. The MLI program can be used to finance properties with a minimum of 5 units. In Toronto, this can be achieved by combining a 4 plex (which is now “as of right”) with a laneway house or garden suite. Below are the unique benefits of the MLI Select program: 90% Purchase and Construction Financing. Low Fixed Rate 50 Year Amortization Limited Recourse Loan No Ongoing Income Barriers Conclusion: Combined together, the government's recent policy changes have create a unique and lucrative opportunity for investors. Their actions have made clear that the "missing middle" is the exact type of real estate investments that want investors to focus on. As with all government policies, these benefits should be looked at as temporary and the most proactive investors will be the ones that benefit the most from them. When you combine the temporary pause in price increases with the potential to save hundreds of thousands of dollars in development charges and HST payments as well as to power of the MIL select program, 2024 has the ability to one of the best investment opportunieis in years.

Read more

House hacking in 2024. A unique opportunity.

As interest rates have risen over the past couple of years, the headlines have overwhelmingly focused on the impact they have had on monthly payments. While prices did pull back temporarily, they have generally remained steady as higher interest rates have been offset by record immigration and a historic lack of inventory. Hidden in all of this noise is that the current market conditions, and temporary pause in price increases, have created an amazing and lucrative opportunity for a specific type of buyers. The house hackers. House hacking is when you rent out a portion of your property in order to help outsource your monthly costs. This can be as simple as renting a room in a condo, or can expand into renting out multiple units in a house. House hacking is one of the safest and most effective ways of building long term wealth because it allows homeowners to outsource their debt while also giving them the flexibility to pick and choose when to maximize rent vs lifestyle. House Hacking Examples 1. A single family house with a basement apartment. This is the most common form of house hacking. Basement apartments are cost effective to build and generate strong rents, while leaving the homeowner to enjoy near maximum use of their space. 2. A single family house with a laneway house or garden suite. Similiar to basement apartments, laneway houses allow the homeowner to enjoy maximum use of the main property. While constructing a laneway house is more costly than a basement apartment, the return on investment and immediate cashflow is still strong. The added benefit of a laneway house is that it is a fully detached dwelling and provides maximum privacy for the homeowner. 3. A multi unit house. These type of properties offer the maximum financial benefit for a homeowner. A fourplex home with a laneway house can create a "live for free" scenario where the tenants cover all of the monthly expenses for homeowner. The homeowner has the flexibility to choose which unit to live in depending on the amount of income they wish to generate. For example, they could live in the laneway house and rent out the main house if their focus is on lifestyle. Conversly, they could live in the basement and rent out the rest of the property if their priority was to maximize revenue. Who should be house hacking now? Those who own a condo or house and are looking to upsize. The rise in interest rates over the past couple of years provided a pause in what had been an extended period of explosive growth in home prices. In addition to this, the rise in construction costs combined with slower price growth has pushed flippers and speculators out of the market. This has created a unique opportunity for end users to purchase excellent properties at common sense prices. Parents who want to responsibly buy a home for their kids. A 2021 study conducted by CIBC found that gifting for downpayments exceeded $10 Billion in 2021. The average gift amount in Toronto was $130,000 for first time buyers and $200,000 for move up buyers. While these gifts cetainly help buyers close on properties, they are often still left with large mortgages and high monthly payments. House hacking is a way to help your kids upsize into their future home, while also leaving them house rich. By outsourcing part, or all of their monthly costs, it will help them build long term wealth while leaving them with the flexibility of expanding their own living space as they feel more comfortable doing so. Remember there is a different between what you can afford and what you should afford. People who are looking to buy a property with family or friends. (Co-buyer) As real estate prices have skyrocketed across the GTA in recent years, it has made the dream of homeownership seem impossible for many. Co-buying is a solution that will without question see a massive increase in popularity in the years ahead. Purchasing a multi-unit house with a friend or family member presents a myriad of advantages for individuals seeking both financial stability and collaborative living arrangements. Firstly, the cost-sharing aspect allows buyers to pool resources, making homeownership in the city's competitive real estate market more accessible. Shared responsibilities for mortgage payments, property taxes, and maintenance costs lighten the financial burden on each co-buyer. Additionally, the potential for rental income from the multiple units provides a steady stream of revenue, contributing to mortgage repayment and overall investment returns. Mistakes to Avoid Timing the market to maximize your current property. Generally speaking, while the value of your current property might not be at its peak price, if you are moving up to a more expensive property, the discount you will receive on the purchase of the new property will outweigh any perceived loss on your current one. Don’t be afraid of a larger mortgage. If you have tenants helping you pay it, you are actually outsourcing your debt, and this is one of the fundamentals of building wealth. While upsizing and taking on a larger mortgage (especially at the current rates) may be intimidating, let the numbers and common sense guide you. Depending on the property you buy, and how much of it you rent, you may pay less every month than what you do currently, and with the right property, you could pay nothing at all. Being closed minded about co-buying. At the end of the day, real estate is almost always as much about investing as it is about finding a place to call home. The saying that "fortune favours the bold" wasn't created by accident. The most successful people in the world all have business partners. In fact, almost everyone in world has business partner in the form of spouse. So why is it that when it comes to buying a property, it's either all ours or nothing? Co-buying allows people to potentially enter the market sooner (at lower prices) as well to offset their monthly costs. With the ability to build laneway houses up to 1700 square feet, multiple owners can still create a detached and private living environment where both owners enjoy maximum benefit from the property. So why is now the time to house hack? Simply put, the numbers just make sense… regardless of the interest rates. There are excellent properties selling at attractive prices every single week. As a buyer in this market, you can find a multi unit property where you can live in one of the units and rent out the others. Additionally, you can find an attractive single family home with the ability to build a laneway house for a fraction of buying two separate houses. These scenarios allow buyers to reduce and sometimes even eliminate their monthly living expenses. In addition, outsourcing debt is one of the most powerful tools to building long term wealth. In our current market, a condo that is purchased as an investment, would not have it's monthly costs covered by the tenant. Conversely, you can absolutely find a multiplex house that is cash flow neutral or even positive. Moreover, while a condominium can either function as the owner's residence or be rented out, it cannot simultaneously fulfill both roles. In contrast, a multiplex house offers the added advantage of serving as both a home for its owner and an investment vehicle. This is where the opportunity lies. As a final thought, house hacking doesn't need to be looked at as a permanant living arrangement. It allows homeowners to be flexibile and to adapt their living arrangements to suit their situation and lifestyle. It also provides ongoing financial security and can contribute substantially to your long term wealth.

Read more